Let’s be honest. Life is a series of bets. Not just at the casino, but in the boardroom, the stock market, even the grocery aisle. You’re constantly weighing odds, predicting outcomes, and managing risk with imperfect information. Sound familiar? It should. It’s the exact same game a poker pro plays every hand.

Here’s the deal: the marriage of poker strategy and behavioral economics—the study of why we make irrational financial choices—is a masterclass in cutting through our own mental fog. It’s about seeing the hidden patterns in the chaos, both on the felt and in your everyday life.

Your Brain: The Ultimate Tilt Machine

Behavioral economists have cataloged a zoo of cognitive biases that warp our judgment. Poker players, well, they’ve felt them in real-time, often to their devastating cost. They just use different names for the same monsters.

Sunk Cost Fallacy vs. “Chasing”

In economics, the sunk cost fallacy is our tendency to throw good money after bad because we’ve already invested so much. You know, like finishing a terrible movie just because you paid for the ticket.

At the poker table, it’s called “chasing.” You’ve put half your chips in with a weak draw. The turn card misses. The rational move is to fold. But that previous investment? It tugs at you. “I’ve come this far…” That emotional pull, that inability to ignore sunk costs, is what separates amateurs from pros. A pro folds, knowing the past bet is irrelevant. Only the future odds matter.

Loss Aversion and “Passive Play”

Studies show losses hurt about twice as much as gains feel good. This is loss aversion. In poker, this bias manifests as passive, scared play—checking and calling when you should be betting and raising, simply to avoid the pain of being bluffed. You prioritize avoiding a short-term loss over maximizing long-term gain. You become predictable. Exploitable.

The lesson? Framing is everything. Viewing decisions not as “I could lose $100” but as “this is a +EV (expected value) move that will win over time” reframes the entire mental game. It’s about the process, not the single, painful outcome.

The Poker Player’s Toolkit for Rational Thinking

So how do the best in the game combat these innate flaws? They build mental models. They create habits that act as guardrails against their own psychology.

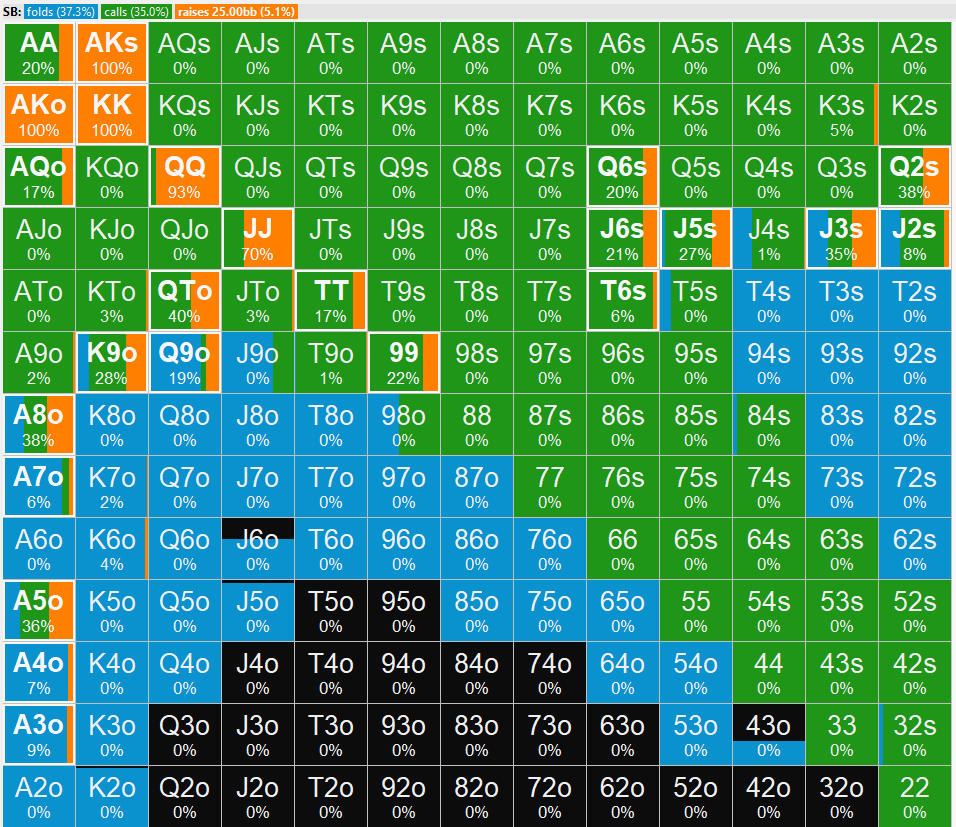

1. Thinking in Ranges, Not Certainties

A novice thinks, “He has aces.” A pro thinks, “His range here is aces, kings, maybe ace-king, with a small chance of a bluff.” This shift from binary (yes/no) to probabilistic (a spectrum of likelihoods) is profound. It directly counters our brain’s love for neat, confident stories—what economists might call narrative bias.

Applying this to, say, a job interview? Don’t think “I’ll get it” or “I won’t.” Think in ranges. “Given my skills and the market, I have a strong chance. Here’s my plan for each possible outcome.” It reduces emotional whiplash.

2. Expected Value (EV): The North Star

Every poker decision is boiled down to Expected Value. It’s a cold, mathematical average of all possible outcomes. A play can lose money but still be +EV if, over hundreds of repetitions, it shows a profit. This is the ultimate antidote to results-oriented thinking—the dangerous habit of judging a decision solely by its immediate outcome.

You made a great bluff that got called? Bad result, good decision. You called with a weak hand and got lucky? Terrible decision, good result. Separating the two is maybe the single hardest, yet most crucial, skill for clear decision-making anywhere.

3. Bankroll Management: The Ultimate Reality Check

This is about knowing the difference between risk and ruin. No serious player risks a significant portion of their stack on a single, volatile gamble. They know variance—the short-term luck factor—is a brutal force. It’s a formalized system against overconfidence and the temptation of a “quick score.”

In life? That’s your emergency fund. It’s diversification. It’s not betting the farm on one “sure thing” stock tip. It’s the structural humility that says, “I could be wrong, and I need to survive to play another day.”

Practical Applications: Off the Felt and Into Your Life

Alright, let’s get concrete. How do you actually use this mashup of cards and cognitive science?

| Situation | Poker/BE Principle | Practical Takeaway |

| Negotiating a Salary | Thinking in Ranges; Loss Aversion | Don’t fixate on one number. Have a range (target to walk-away). Remember, the other side fears losing you (their loss aversion) as much as you fear not getting the job. |

| Investing | Expected Value; Bankroll Management | Focus on the long-term strategy, not daily portfolio swings (results-oriented thinking). Never risk capital you can’t afford to lose (ruin). |

| Business Pivot | Sunk Cost Fallacy | Past investment (time, money, ego) is irrelevant. The only question: does the future path have positive EV? If not, fold the project. |

| Daily Choices | Emotional “Tilt” Control | Recognize when you’re emotionally compromised—after an argument, a bad sleep, a stressor—and avoid major decisions. Take a break. Rebuy your mental stack. |

The real secret isn’t in complex math. It’s in the mindset. It’s about embracing uncertainty as the default state, not an annoyance. It’s about making peace with the fact that good decisions can fail and bad ones can sometimes win. The goal isn’t to be right every time. That’s impossible. The goal is to have a process that, over the long run, tilts the odds in your favor.

In the end, poker and behavioral economics teach the same humbling, powerful truth: often, the biggest obstacle to success isn’t the other players at the table. It’s the one sitting in your chair, making choices through a flawed, emotional lens. The work—the fascinating, lifelong work—is learning to outthink that version of yourself.